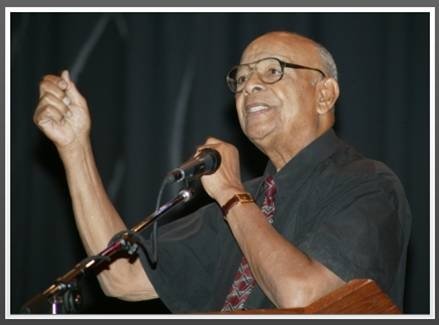

First, let me say this: I’m a life-long Lakers fan. It was my father’s favorite team in the 80’s when Magic, Worthy, and Kareem were running the Showtime fast break.

Yup, life-long… er… w-well with the exception of the

Chicago Bulls dynasty runs but I digress.

The Los Angeles Lakers of this past NBA season

have been a complete enigma to their fans.

It’s been filled with moments of nirvana…

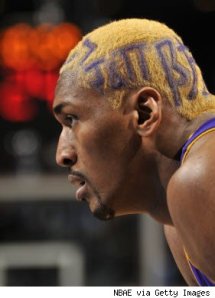

…with echoes of … umm twisted genius…

…(Or could that be omens of impending implosion?)…

Jump-ball

But even with their occasional inconsistency binges, there are at least 3 valuable things we can all learn from their recent season and current playoffs run to defend their title. So let’s tip-off shall we?

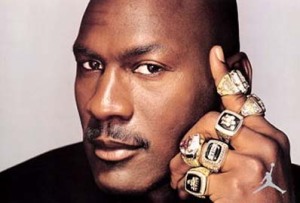

#1 Success is a moving target

Ask Jordan, ask Ali, ask Tom Brady. Ask any former champion just how hard it is to get BACK on top after you’ve already been there. The Lakers are still the defending champions after winning the title last June, but what can their struggles this year teach us?

Well, for starters Success is a moving target. When I get out of debt, in order to maintain my debt freedom, I will have to continue doing what got me out of debt! The fact is I’ll NEVER be at a place where I can just say “Ah, I’ve made it, I can STOP now!” And this applies not just to money but any area in which you hope to maintain any real level of success.

#2 The larger the letdown , the less likely the loyalty

All Lakers fans are bandwagoners, ALL OF THEM, except maybe Jack Nicholson… and possibly Lakers Owner Jerry Buss. Even I have had my moments. (See second paragraph of this post.) After the last 2 losses in the first round of this year’s playoffs, even die-hard “fans” have begun to question if the Lakers can ascend the heights of hoopdom again this year. Suddenly, Naysayers abound!

The point here is that being a true fan is supposed to be an act of Loyalty. Not just the type of Hollywood “fan” that shows up court side on Christmas day, or shows up on camera just as the announcers happen to be talking about their next blockbuster, or the ones who can remember when Kobe dropped 81 points. The kind of loyalty I’m talking about is akin to the type of fan that remembers the Nick Van Exel, Eddie Jones, and Cedric Ceballos led Lakers of the late 90’s that preceded the 3-peat Shaq & Kobe special… and still LOVED them because they were Lakers.

Make sure you’re showing THAT kind of loyalty to the things that matter. You can do this by tithing, giving to charities, and paying yourself first by saving for emergencies and putting something away for retirement. Love YOURSELF!

#3 Never put all of your eggs in one hoop bucket basket

I’m talking to you, Kobe. I know ALL about your greatness in playoffs past, and I’m looking forward to your continued assault on the All-time scoring leader list next season. But for right now, beginning with Game 5 of your 1st round series against the Oklahoma City Thunder, I DON’T need to see you chucking up every flailing desperation shot attempt on every possession down the court. If ever this quote applied, it surely applies to your valiant effort so far this post season:

“We’re all in the gutter, but some of us are still looking at the stars.” – Oscar Wilde

Your ambition in spite of the doubts and injuries is simply awe-inspiring, but at the same time, MY GOSH MAN it’s also terror inducing!

The lesson I’m learning here is to make sure you spread the wealth.

If you let all of you hopes ride on just one pony, what happens when that pony pulls a hamstring? Conversely, Just because you’re the leader doesn’t mean that your other teammates aren’t expected to perform their roles, so allow them to do their jobs too!

The same applies to your money. You never want to spend it all in one place. You have categories that each need to be addressed: Food, Clothing, Shelter, Transportation. I can’t just go out and spend my entire paycheck on Clothing and Gas. (Unless I plan to sleep in my car and drink petrol since I’m neglecting my need for Shelter and Food!) Got it? Good, now spread it around.

Well I hope this has been insightful for you whether you follow the NBA or not! These types of life lessons can be gleaned from just about any other activity in the exact same way.

Live Invincibly,

@W

![Reblog this post [with Zemanta]](https://i0.wp.com/img.zemanta.com/reblog_e.png)